Accounting Software Malaysia Supports SST

Different tax codes can be managed according to Malaysian SST rate for each transaction and items.

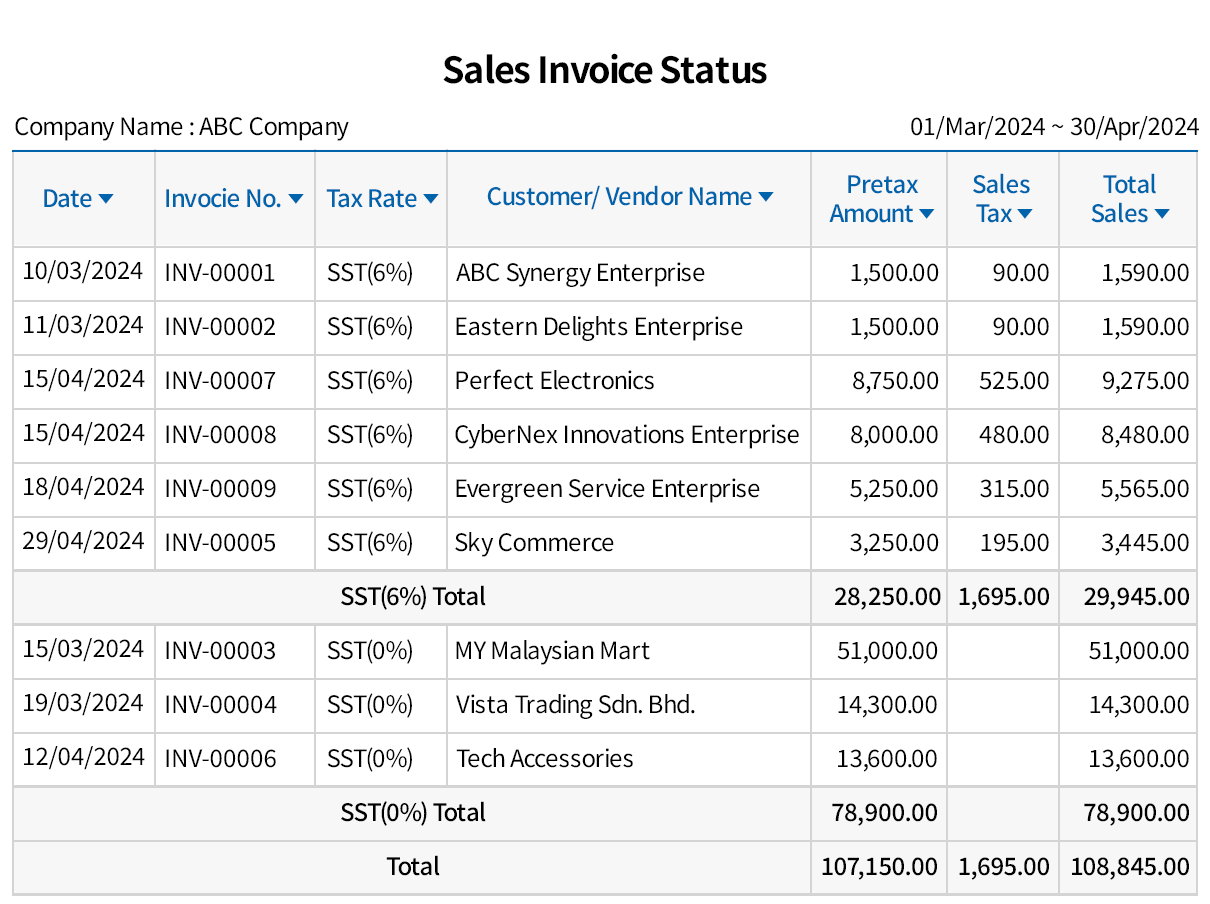

Tax amount and payable amount can be checked at a glance in various reports.

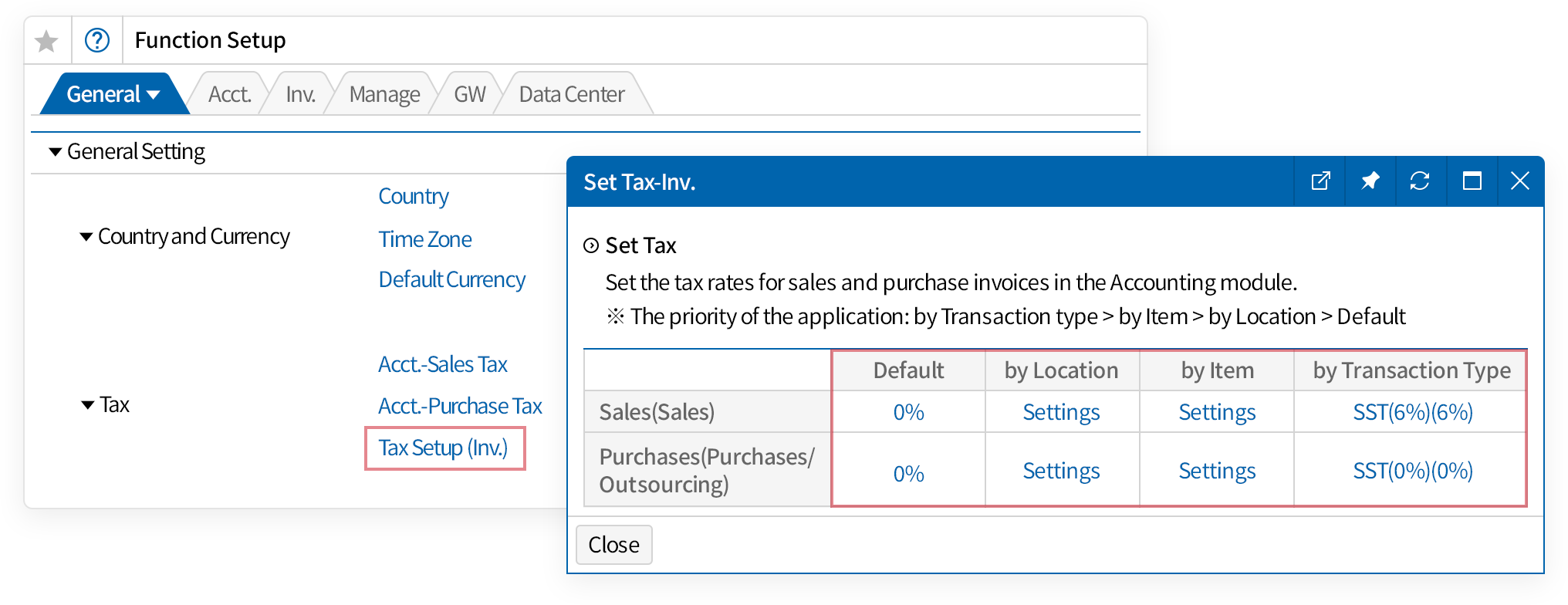

Registering Tax Rate

- The functionality in User-Customization enables you to register different type of tax rate whenever you need it.

- Not only different SST rate, you can also set the SST rate based on location, item, customer/vendor.

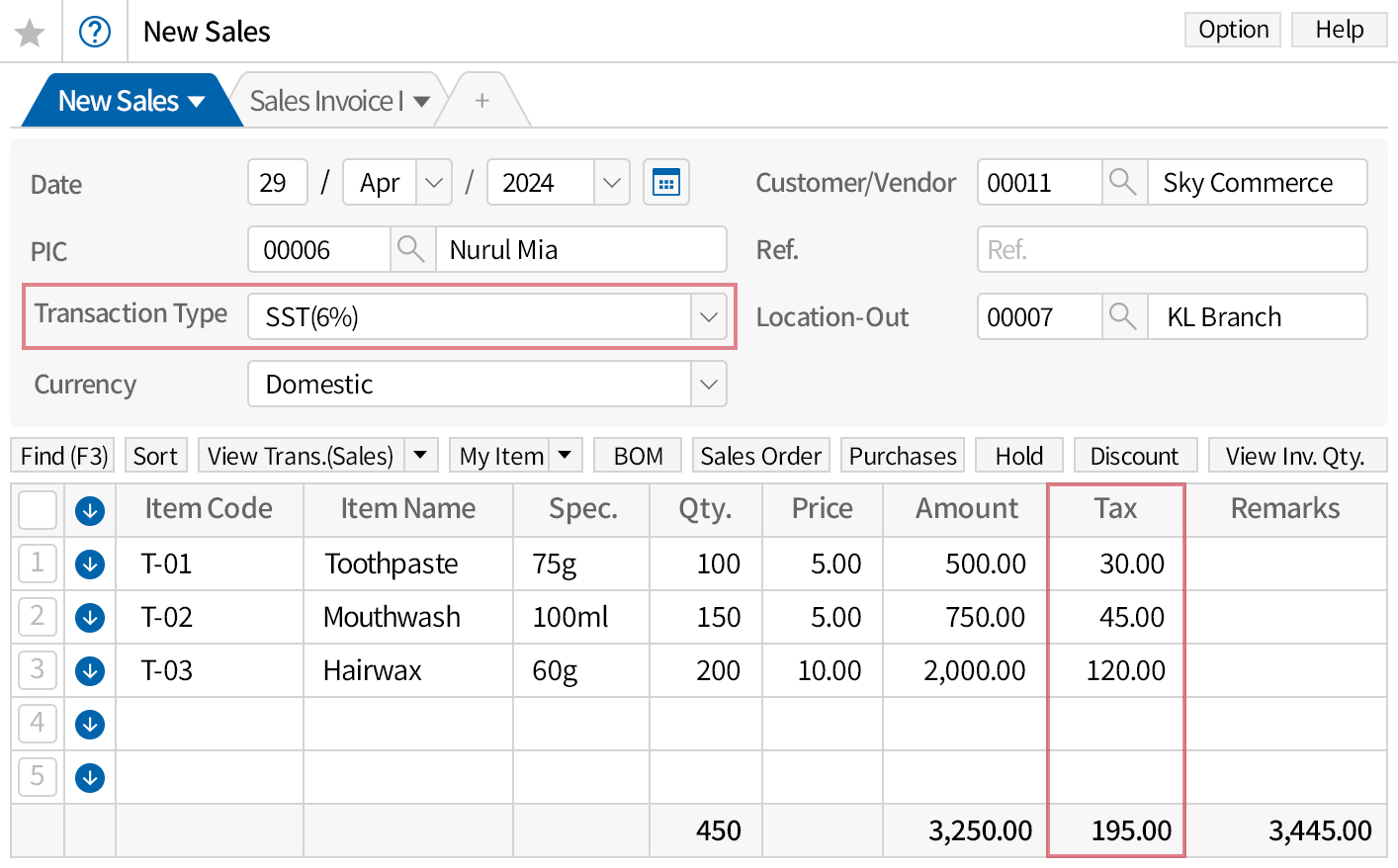

Automatic Tax Rate Adjustment

to Transaction

- It enables allocating any SST rate for each transaction.

- Transaction type will automatically adjust the SST rate

based on the tax setting.

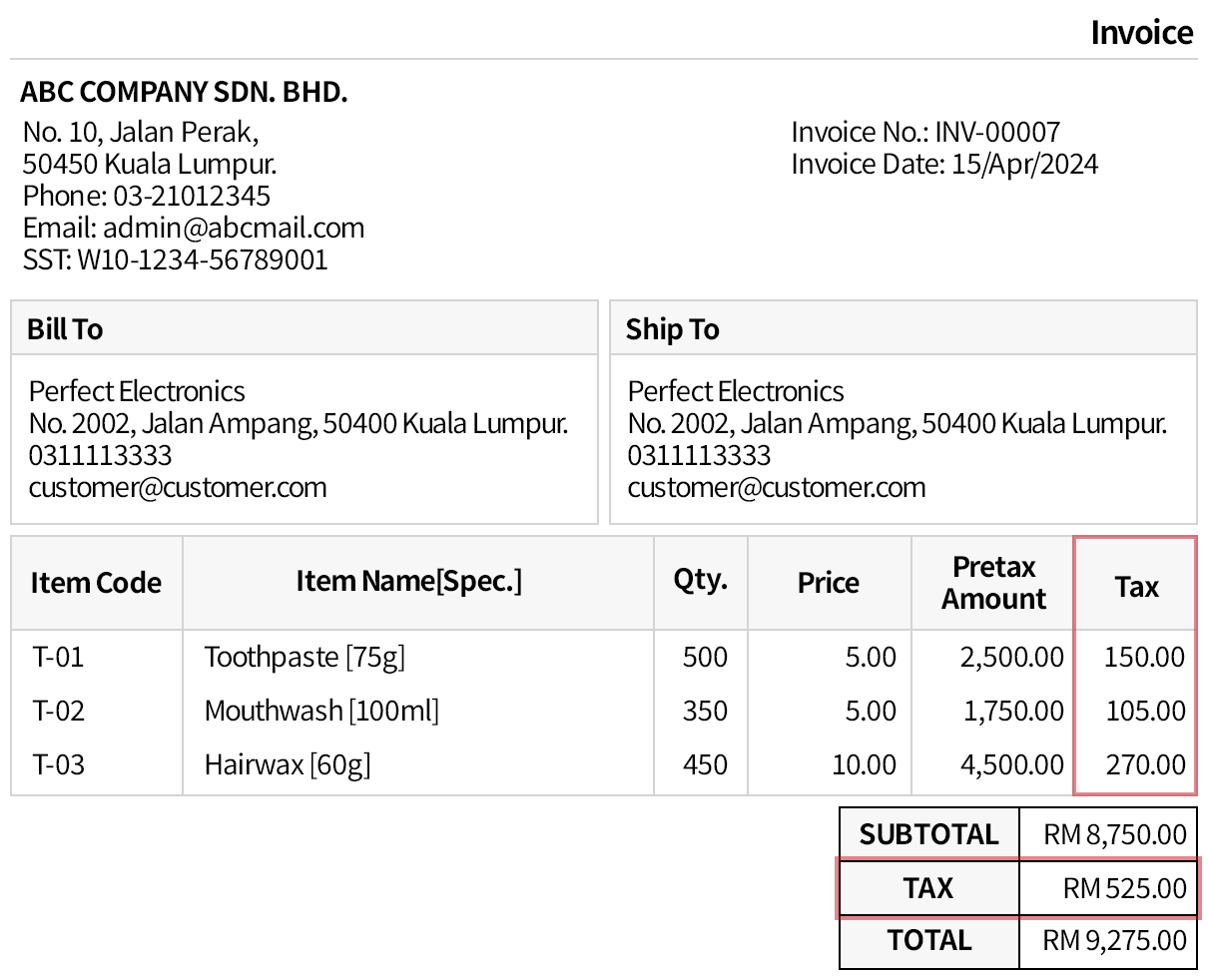

Various Types of Tax Amount Reports

-

Including SST amount in the Invoice.

-

Generate total tax amount in a report.