Cost Management

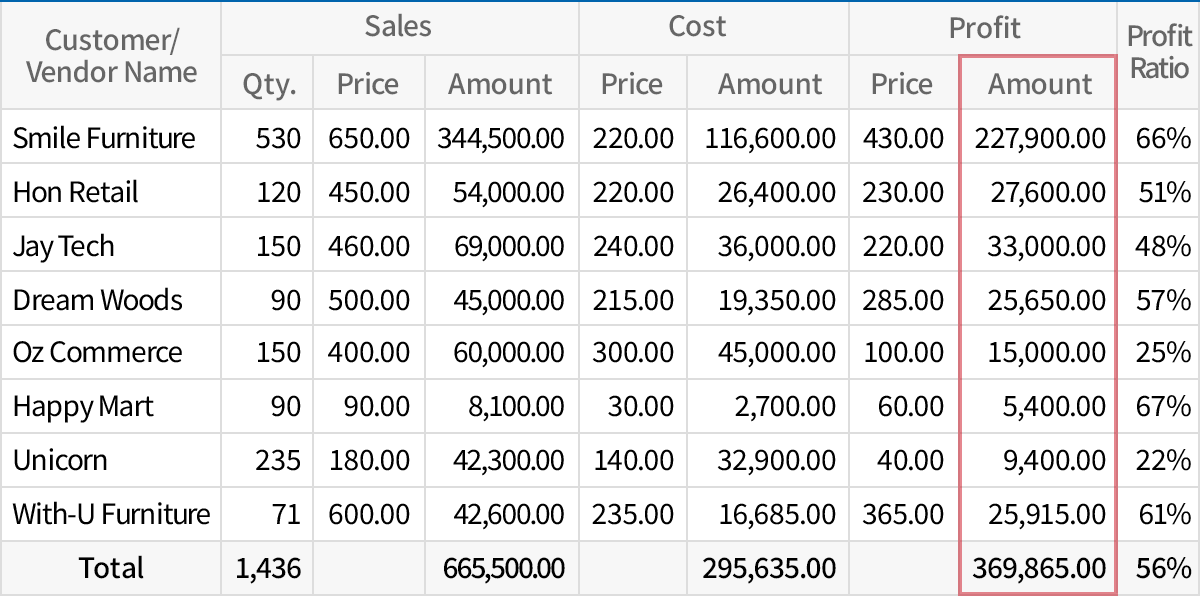

ECOUNT automatically calculates costs and profits

based on your purchase, production, and sales records.

Cost Calculation Methods

Tailored to Your Business

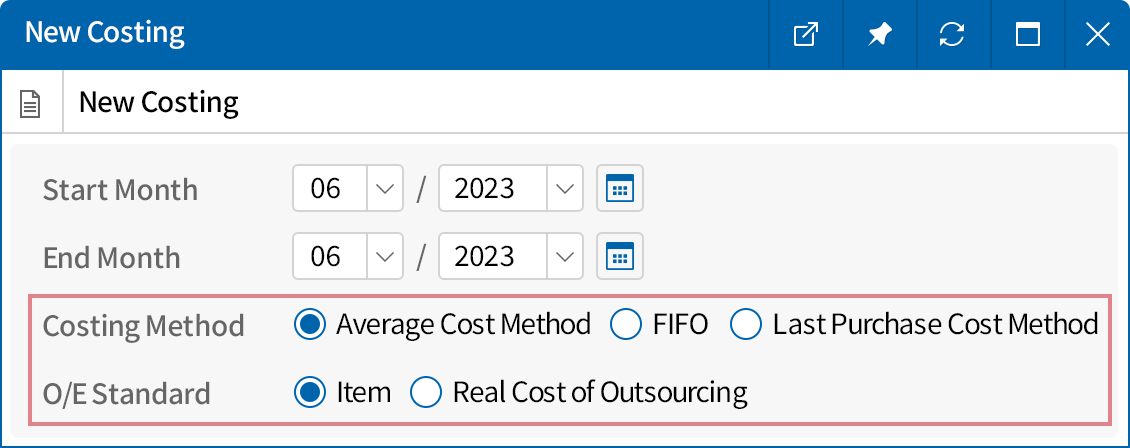

- You can select your preferred cost calculation method

(Average Cost/FIFO/Latest Purchase Cost)

to calculate the monthly manufacturing cost of your products. - You may choose whether to calculate costs based on the

pre-entered outsourcing cost at the time of

item registration or the actual outsourcing cost,

and reflect this in your cost calculations. - Labor costs, expenses, and import incidental costs can

be reflected in the cost by process or by item.

Estimated Cost vs. Actual Cost

- Compare the estimated (expected) cost based on the BOM before production with the actual cost after production.

- Accurately analyze the causes of cost differences for each item, such as differences in material prices or consumption quantities.