Payroll Management Easily issue and distribute payslips upon automatic calculation of salaries based on employee details.

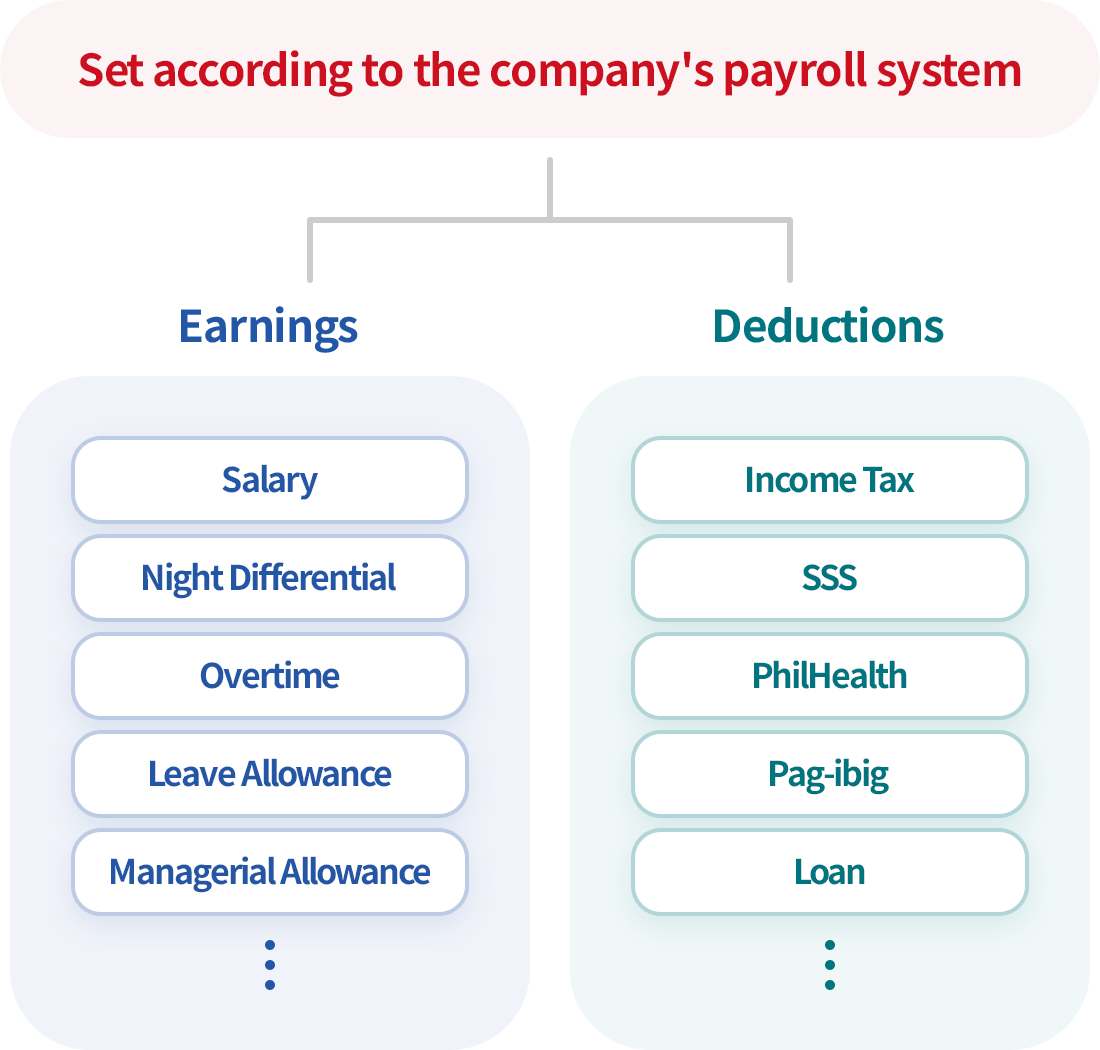

Configure Earnings and

Deductions According to

Payroll Calculation Methods

- Freely add or modify employee earnings and deductions.

- Set the payment type (fixed/hourly/daily),

non-taxable, calculation formula for each earning. - Specify which earning or deduction is applied

to an employee and set individual amounts for each. - Calculate the payroll by department or project

based on the payment frequency.

Automatic Payroll Calculation Reflecting

Various Earnings and Deductions

- Payroll is automatically calculated based on the registered employee information.

- Hourly and daily earnings can be easily calculated from the attendance records.

- Income tax and major social insurances are calculated in accordance with the latest tax laws.

- Various reports such as payroll book and payroll status are provided.

Easily Deliver Payslips

- Payroll calculation details are automatically

reflected in the payslips. - Payslips can be sent to employees individually

or in batch via email. - Customize the payslips according to the

company's needs by adding details like total earnings,

total deductions, formula, etc.

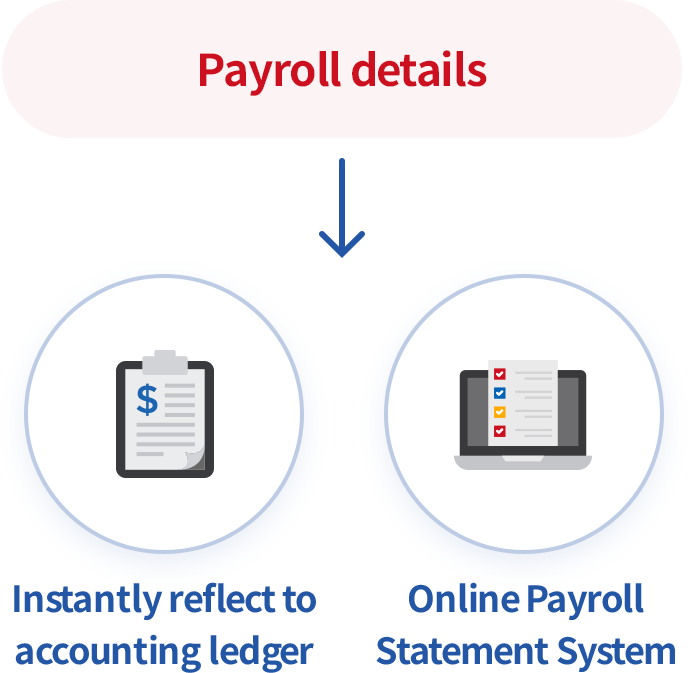

More Convenient Payroll Management

through ERP Integration

- Payroll payment details can be immediately reflected in accounting books.

- Employees can directly view their own payslips through an Online Payroll

Statement System (UserPay).