Payroll Management

You can automatically calculate salaries based on employee information

and easily issue/distribute payroll slips.

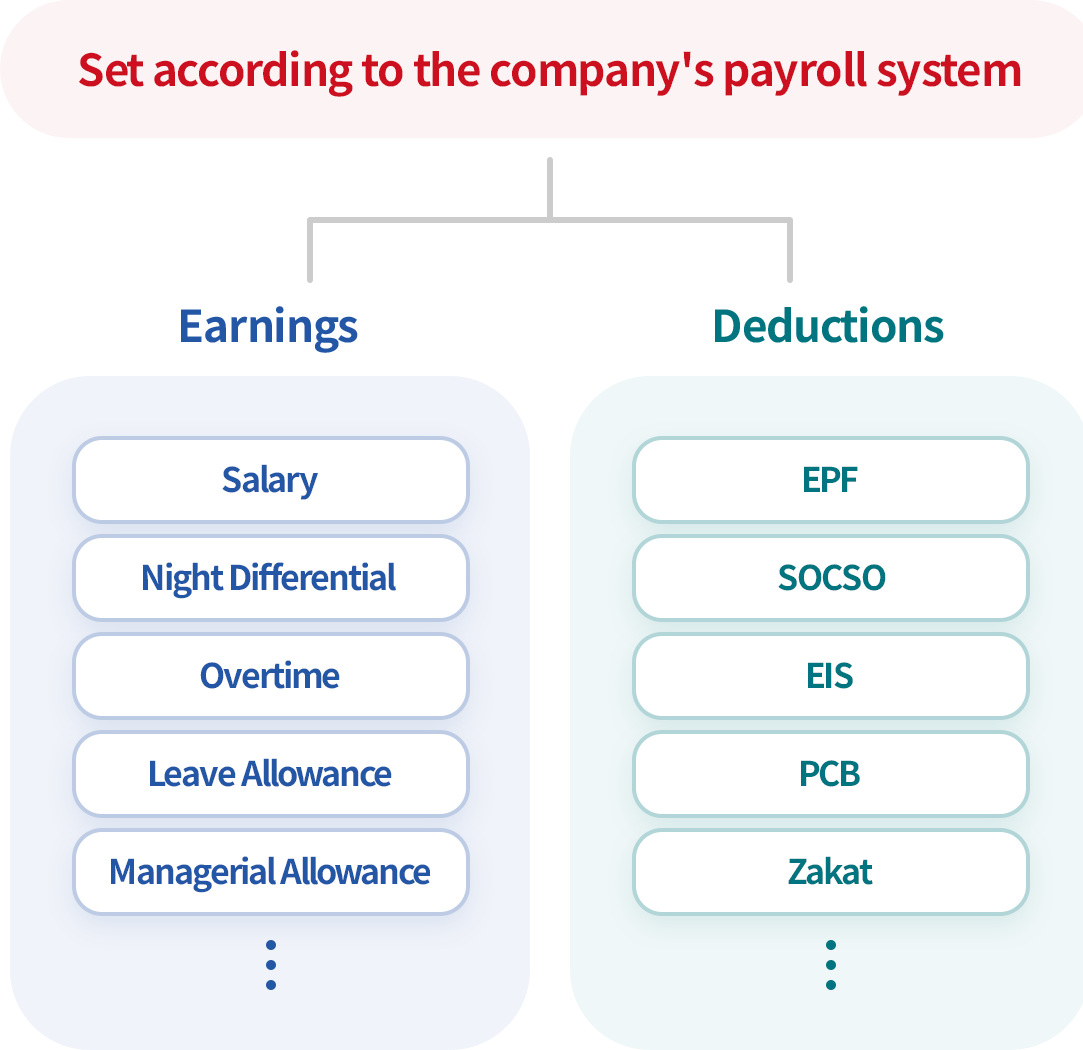

Setting allowances and deductions

according to payroll calculation method

- Add/modify allowances and deductions.

- Set the payment type (fixed, hourly, daily), formulas for each allowance.

- Input whether each payroll allowance or deduction is applicable

to each employee and specify the amount. - Calculate the payroll by department or project

based on the payment frequency.

Automatic payroll calculation

- Payroll is automatically calculated based on the registered employee information.

- Calculate the hourly/daily allowances by linking them with attendance records.

- Various reports such as payroll ledger, payroll summary, and payroll transfer status are provided.

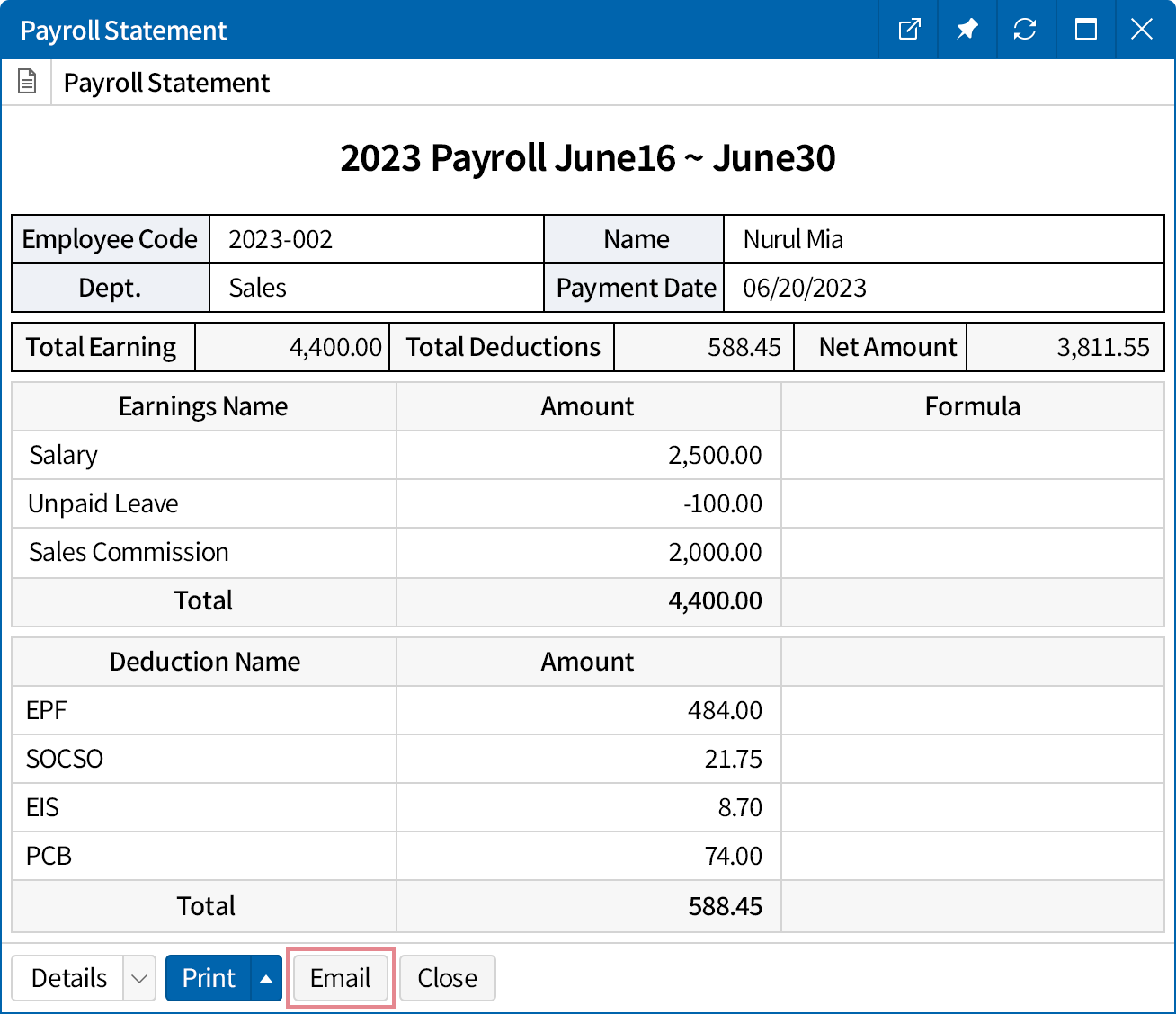

Deliver payslips conveniently

- Payroll calculation details are automatically reflected in the

payslips. - Send payslips individually or in batch to employees via email.

- Customize the payslips according to the company's needs by

adding details like total earnings, total deductions, formula, etc.

Link to other ERP functions

for easy payroll management

- Immediately reflect payroll payment details in the accounting ledger.

- Employees can directly check their own payroll information through

the Online Payroll Statement System.