What is Accounting Software?

Definition of Accounting Software

Accounting software refers to software that systematically records and manages various accounting tasks such as transaction details, accounts receivable/payable, and fund status that occur during company operations.

The main purpose of using accounting software is to computerize accounting books that were previously prepared manually,

allowing for easy management and efficient handling of complex accounting tasks.

By utilizing accounting software, you can consolidate vast amounts of accounting data in one place,

and streamline various accounting processes such as managing receivables/payables, budgeting, and monitoring cash flow.

Considerations When Choosing an Accounting Software

For the successful adoption of accounting software, it is essential to thoroughly check whether the program fits your company’s business environment from various perspectives.

-

1) Reasonable Pricing: The most expensive program is not always the best, so it is important to find accounting software that suits your company.

The software should provide all the necessary functions for your workflow, while being reasonably priced according to your company’s financial situation. -

2) Ease of Use: No matter how many features a program has, if users cannot utilize it properly, it is of no use.

To make work easier with accounting software, it must provide a user-friendly environment that anyone can use with ease. -

3) Integrated Management: If each department manages its tasks with different programs, redundant work is repeated, leading to inefficiency.

Therefore, it should be possible to manage and conveniently share all company tasks such as inventory, accounting, and HR with a single program. -

4) Training and Consultation Support: Even with great accounting software, it can be difficult to keep using it effectively without sufficient training or support.

To ensure successful adoption and use after implementation, systematic training and customer consultation support are necessary.

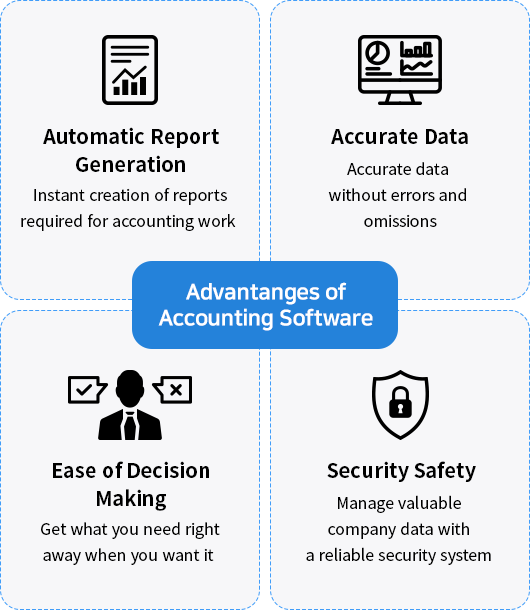

Four Advantages of Using an Accounting Software

By introducing accounting software, tasks such as voucher creation and work sharing become easier, simplifying complex procedures and saving time.

In addition, it prevents errors that may occur when entering books manually, resulting in more accurate accounting data.

Various accounting reports provided by accounting software serve as useful indicators for business managers and personnel

to monitor, analyze, and improve business performance and financial status.

-

1. Reports are Generated Automatically

When you enter transaction details such as purchases/sales and payments/receipts into the accounting software, they are

immediately reflected in various reportssuch as receivables/payables, cash report, costing, and profit and loss.

Since accounting reports are generated automatically, you can save the time spent manually creating and editing reports. -

2. Minimizes Input Errors and Omissions

Using accounting software helps prevent mistakes such as data discrepancies or omissions.

Error-free data and reports can be effectively used for accurate analysis of your company’s financial status. -

3. Enables Promp and Accurate Decision-Making

If you cannot quickly check the necessary data or if the data is unreliable, prompt decision-making becomes difficult.

With accounting software, you can instantly check accurate reports whenever needed, supporting timely management decisions. -

4. Secure Data Management

Using accounting software reduces the risk of data loss or indiscriminate exposure compared to storing documents on paper.

The information security system provided by the program enhances the safety of your company’s valuable data.

ECOUNT Accounting Software

ECOUNT Accounting Software is standardized with various features so that companies of all industries and business types can use it.

With ECOUNT, simply entering the customer and amount will automatically generate the journal entry, allowing even those without accounting knowledge to easily create vouchers.

In addition, there is no need to create separate reports, as accounting books such as balance sheets and monthly profit and loss statements are automatically generated, enabling real-time performance monitoring.

Advantages of ECOUNT Accounting Software

-

1) Easy Data Entry

When you enter various transaction details such as purchases/sales and payments/receipts, journal entries are automatically generated.

Even beginners with no accounting experience can easily manage accounting with ECOUNT. -

2) Integration of External Data (Bank Statement/Payment Gateway)

You can link external data such as bank account transactions, card purchase/sales details, and PG company payment details, and save them as vouchers.

This reduces the time spent checking and entering data one by one, and allows for fund management without missing any data. -

3) Integration with GW (Groupware)

ECOUNT can be linked with groupware, so it is easily to share work between departments.

Moreover, slips entered into accounting softwares such as payment journals, can be uploaded directly to e-Approval. -

4) Create Accounting Books Automatically

When you enter transaction details into ECOUNT, they are immediately reflected in the customer's receivables/payables and accounting books are generated automatically.

You can easily check performance status through various outputs such as customer/vendor books and monthly purchase/sales summaries. -

5) Various Accounting Reports

You can check various accounting reports in real time, such as monthly profit and loss analysis, income statements, balance sheets, and cash reports.

Since you can instantly check the data necessary for management decisions, faster and more rational decision-making is possible.